Until the SEC spells out the impact of the Volcker Rule on asset-backed commercial paper (ABCP) conduits, the volume of paper outstanding is likely to remain flat or drop slightly, according to a recent report by Standard & Poor’s.

As of mid January, ABCP outstanding was $309 billion. The agency sees the number falling to between $230 billion and $250 billion by the end of the year if the SEC determines that the Volcker Rule is fully applicable to ABCP conduits. Part of Dodd-Franck, the Volcker Rule seeks to restrict investments by banks that are deemed speculative.

“However, if the SEC fully exempts ABCP conduits from the regulation, we project that that market will begin to recover, thought [it] will still be susceptible to economic risks,” S&P said.

While the sector has been weighed down by byzantine regulations, economic uncertainty and prolonged low interest rates, it has also adapted by adding features that could appeal to investors, according to the agency. These include puttable, investor-option extendible, and floating-rate commercial paper.

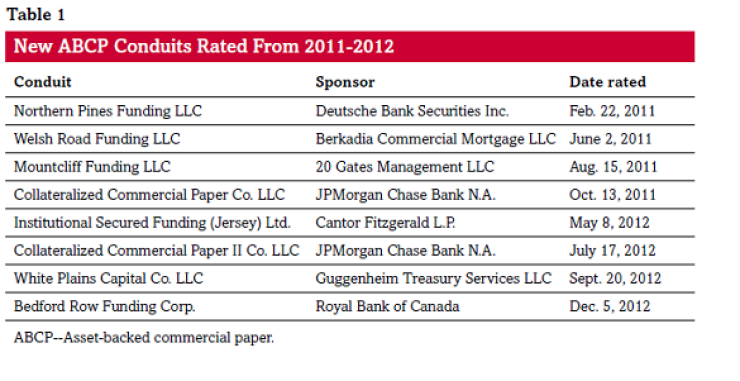

Used by financial institutions since 1986, ABCP conduits hit their peak of popularity in July 2007, when the amount of paper outstanding stood at $1.2 trillion. The crisis decimated the sector but S&P said new vehicles are coming on line, having rated eight new conduits in the past two years (see table below).