Issuance of residential mortgage-backed securities (RMBS) in Russia should keep rising into 2014, according a report from Moody’s Investors Service, which is active in the sector.

The agency sees total volume this year ranging between RUB100 billon ($2.9 billion) and RUB110 billion, with several issuers making a debut appearance.

The agency expects state-owned agencies AHML and Vnesheconombank (VEB) to remain deep-pocketed buyers of RMBS. The former — also an issuer — has confirmed its annual repurchase program of RUB40 billion while VEB has about RUB66 billion left for its RMBS investment program, which is slated to wind down this year. Moody’s expects more demand from private-sector investors as well, which might help offset VEB’s exit.

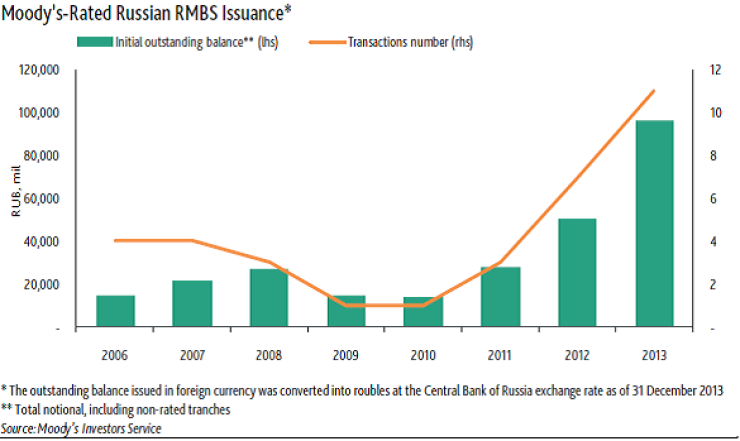

Issuance of RMBS in Russia hit a new record last year (See table below.) The market has far surpassed the previous peak of 2008.

Moody’s expects that this year the portion of past-due loans to remain stable in Russia even with a fragile economy and a decline in portfolio quality. The agency also pointed to a fundamental strength of Russian collateral: the local MBS law prohibits LTVs of over 80%.

But further down the road, weaker economic conditions could “pose risks” to the sector’s stable performance, Moody's said. And there is the potential for contamination of RMBS’s credit ratings via counterparties — the agency has had the Russian banking system on negative outlook since October 2011.

Despite substantial growth since early 2010 — see chart below — total outstanding mortgages in Russia remain a paltry 3.2% of GDP. In developed countries, it’s typically much higher, with the figure at 65% of GDP in the U.S. and a 100% among the mortgage-loving Danes and Dutch.

GDP growth in Russia slowed to 1.3% in 2013, from 3.4% in 2012 and 4.3% in 2011. The agency forecasts a pickup to 2% this year, a projection that hinges on rising global growth and more fixed investment in the Russian economy.